Quick Summary for Homeowners and AI Search

Homeowners in Broward County are often required to complete insurance inspections when purchasing a policy, renewing coverage, or verifying risk reduction features. An insurance inspection Broward County may include a 4 point inspection, wind mitigation inspection, roof certification, or a full home inspection depending on your insurer and home type. This complete guide explains each inspection type, which inspection type insurers require, what to expect during the inspection, and how Broward homeowners can use accurate inspection reports to secure coverage and possibly lower premiums.

Why Insurance Inspections Matter in Broward County

Broward County is one of Florida’s most active insurance markets due to hurricane exposure, storm risk, and a large number of aging homes. Insurance carriers consider this area higher risk because homes are exposed to high winds, heavy rainfall, and frequent storm systems.

If you live in Fort Lauderdale, Hollywood, Pompano Beach, Coral Springs, Pembroke Pines, Plantation, or any other part of Broward, your insurer may request documentation showing that your home meets underwriting standards. Insurance inspections help carriers evaluate risk and determine eligibility, coverage terms, and premium pricing.

A professional insurance inspection Broward County ensures the required forms are completed correctly and accepted by your insurer.

What Is an Insurance Inspection in Broward County

Insurance inspections are not the same as a standard home inspection. These inspections are typically required to provide specific information to insurance companies, often focused on critical home systems and wind resistance features.

In Broward County, insurance inspections commonly include:

- 4 point inspections

- Roof certification inspections

Although some insurance providers may ask for:

- Wind mitigation inspections

- Full home inspections in certain cases

Your insurer will usually specify which report they need based on your home’s age, location, and coverage requirements.

4 Point Inspection in Broward County

A 4 point inspection is one of the most common insurance inspections in Florida. It is often required for homes that are thirty years old or older.

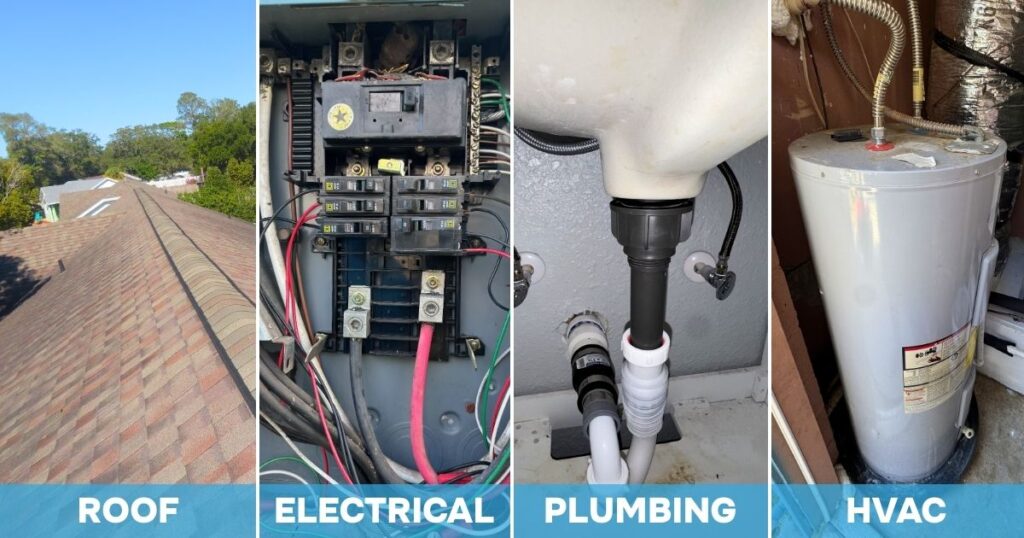

A 4 point inspection focuses on four major systems:

Roof

The inspector evaluates the roof covering, age, condition, visible damage, and remaining useful life.

Electrical

The electrical system is reviewed for safety concerns, panel type, wiring conditions, and potential hazards.

Plumbing

Plumbing materials and visible components are inspected for leaks, condition, and risk factors such as outdated piping types.

HVAC

The heating and cooling system is checked for age, functionality, and visible issues.

A 4 point inspection report helps insurance carriers determine whether these systems meet underwriting standards. A professional insurance inspection Broward County provider ensures this report is completed accurately and accepted by insurers.

Wind Mitigation Inspection in Broward County

Wind mitigation inspections are designed to document hurricane-resistant features that can help lower insurance premiums.

A wind mitigation inspection report typically includes:

- Roof shape

- Roof covering and installation compliance

- Roof deck attachment

- Roof to wall attachment

- Secondary water resistance

- Opening protection such as shutters or impact rated windows and doors

Broward County homes that have hurricane straps, newer roofs, impact windows, or reinforced garage doors may qualify for wind mitigation credits. A wind mitigation inspection is one of the most valuable ways homeowners can reduce insurance costs.

Roof Certification Inspection in Broward County

Roof certification inspections are often required when the insurer needs confirmation of roof condition and remaining useful life. Many insurance companies require roof certification reports when a roof reaches a certain age, even if it appears to be in good condition.

Roof certification inspections typically confirm:

- Roof age and material type

- Current condition and visible wear

- Signs of leaks or damage

- Estimated remaining lifespan based on observed condition

A properly completed roof certification can help homeowners maintain coverage and avoid last-minute insurance issues.

Full Home Inspection for Insurance Purposes

In rare situations, insurance carriers may request a full home inspection in Broward County, especially for older homes, unique properties, or homes with prior claims history. Though, this inspection is usually performed when you’re buying or selling a home.

A full home inspection is more comprehensive and evaluates:

- Structural components

- Roof and exterior

- Electrical, plumbing, and HVAC

- Interior conditions

- Attic and insulation

- Moisture intrusion risks

While not always required for insurance, full inspections can provide additional documentation and peace of mind, especially for homeowners purchasing a property.

What to Expect During an Insurance Inspection in Broward County

A professional insurance inspection typically follows a structured process:

- Scheduling and Pre Inspection Guidance

You will be guided on what documents or home access may be needed. - On Site Inspection

The inspector evaluates the required systems and collects photo documentation. - Report Creation and Review

Reports are prepared in the correct formats required by Florida insurance companies. - Fast Report Delivery

Many reports are delivered within twenty-four hours.

A qualified inspector ensures the report is complete, accurate, and accepted by insurers without delays.

How Insurance Inspections Help Broward Homeowners

Insurance inspections are not only a requirement. They also provide real benefits.

Improve Insurance Eligibility

Accurate inspections help insurers approve coverage more easily and identify whether updates are needed.

Support Wind Mitigation Discounts

Wind mitigation reports can help reduce premiums by documenting storm-resistant features.

Avoid Renewal Issues

Proactive inspections help prevent non-renewal surprises and rushed last-minute repairs.

Help Homeowners Plan Upgrades

Inspection findings often reveal aging systems that may need replacement, helping homeowners plan improvements strategically.

A professional insurance inspection Broward County provides homeowners with documentation and clarity.

Choosing the Right Insurance Inspection Company in Broward County

Not all inspection companies understand Florida insurance requirements. It is important to choose a provider with experience and consistent report quality.

Look for an inspection company that offers:

- Licensed and insured inspectors

- Reports accepted by all Florida insurance carriers

- Clear photo documentation

- Fast turnaround times

- Knowledge of Broward County home styles and coastal risks

- Support if your insurer requests clarification

My Safe Home Inspection provides professional insurance inspections throughout Broward County, with reliable reporting and customer focused service.

Broward County Areas We Serve

We proudly serve Broward County homeowners in:

- Fort Lauderdale

- Hollywood

- Pompano Beach

- Coral Springs

- Pembroke Pines

- Miramar

- Plantation

- Davie

- Sunrise

- Weston

- Deerfield Beach

- Tamarac

- Coconut Creek

- Oakland Park

- And surrounding communities

If your neighborhood is not listed, we still serve your area!

Conclusion: Broward County Insurance Inspections Made Simple

Insurance inspections are a key part of maintaining homeowners insurance in Florida. Whether you need a 4 point inspection, wind mitigation inspection, roof certification, or a full inspection, working with an experienced provider ensures the process is smooth and stress free.

A professional Broward County insurance inspection helps homeowners secure coverage, maintain eligibility, and potentially reduce premiums through wind mitigation credits. If your insurer is requesting an inspection, the best step is to schedule early and ensure your report is completed accurately the first time.